Mobile app

How to Develop Fool-proof Mobile Banking Apps for the Future

Banking is what drives the economy as it provides money to firms to expand their businesses, buy new equipment, purchase land, and to people to buy new homes and cars or to fund their education. Thus, Banks are the primary supplier of credit in the modern economy. The world has gone digital, and Banking is no exception. Mobile banking apps are increasingly being preferred over visiting Banks for transactions or queries. However, with freedom comes responsibility, and banking apps need to be fool-proof to prevent cyber attacks, hacking, and pilferage of funds. In this blog, we will have a close look at the method of developing fool-proof mobile banking apps for the future.

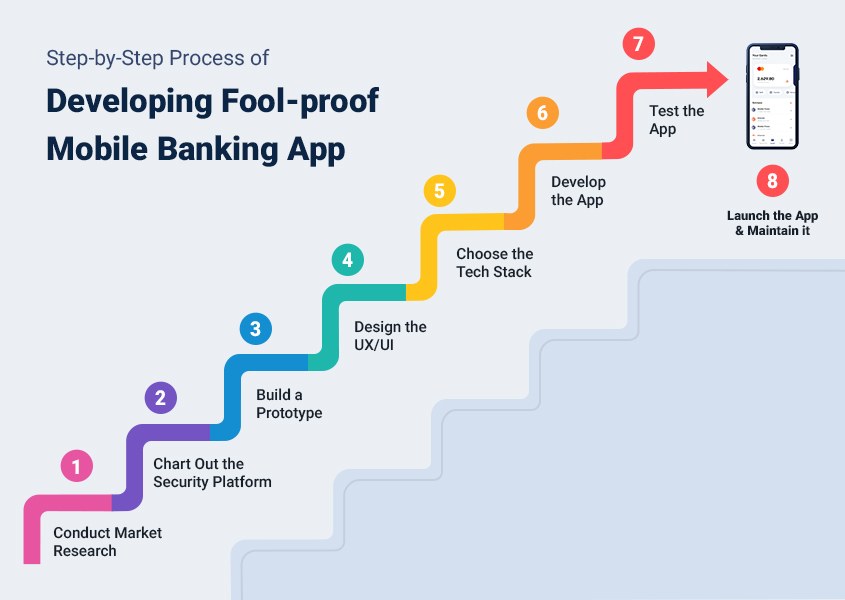

Step-by-Step Process of Developing Fool-proof Mobile Banking App

Banking app development can be a tricky process due to third-party integrations and security concerns. If done methodically, these challenges can be met. Here we look at a step-by-step method of developing a mobile banking app.

Step#1 Conduct Market Research

For any app development project, you should conduct market research to know who your target audience is, what technologies are available, what your competitors are offering, and what your requirements are.

You should also consider the region’s culture and the mindset of the people where the app will be primarily used. For example, in the USA, the majority of the citizens have at least one credit card. So, you need to include a tab specifically for credit cards on your app.

Step#2 Chart Out the Security Platform

All apps need to be secure, but you need to be fool-proof with banking apps for obvious reasons. This is what makes this step the most important one for a mobile banking app. All other features will be irrelevant if the app is vulnerable to hackers.

So, before going forward with any kind of development, be clear about the security features you want to include. Some of the standard security features include the following:

- Secure Password

All passwords should be encrypted and stored in the database.

- Auto Logout

If users are not active on the app for more than a few minutes, they should be logged out from the system

- Secure Authentication

You should go for two-factor authentication, which can include the password and OTP sent to the registered mobile number.

- Data Privacy

Software professionals who create mobile banking apps should have limited access to user information like passwords, account details, phone numbers, and transaction details.

- Secure Card Info

Implement VGS (Very Good Security) technology to display the card information

- Security Certificates

If you have a web app, an SSL certificate is mandatory, and if it is a mobile app – SSL Pinning. This ensures that data transfer between the web server and browser remains secure and private.

Step #3 Build a Prototype

To have a clear picture of your app, you first build a prototype with the app’s logic, structure, and design. Although the prototype may be nowhere near the final product, you will get some idea.

Sometimes, an MVP or Minimum Viable Product can also be built with the essential features to test the app and get feedback from users. The more you analyze your MVP, the better the final product will be.

Step#4 Design the UX/UI

Anyone who uses a mobile banking app will tell you that they are worried about clicking on tabs by mistake and are anxious when transferring a large amount.

For Mobile Banking App, UI should be as simple as possible and intuitive to enable even less educated customers to use it with ease. Tabs, font size, and colors should all be carefully worked upon as they are crucial for a good UX.

The bottom line is “Keep it Simple yet Fast & Secure.”

Step#5 Choose the Tech Stack

You need to choose the right technology before you start the development process. For example, to build banking apps in Android and iOS, React Native is safer than Native. The reason being it provides optimal user experience across both Android and iOS.

However, there is no single stack that fits all banking apps, as it all depends on your requirement and app features. So, choose your tech stack wisely.

You can go for cross-platform app development, which means that the same app can be used on Android or iOS. Hybrid apps are the ones that are built with different web technologies like HTML5, CSS, and JavaScript.

Step#6 Develop the App

It’s time to go for the development, and you can either have in-house development or outsource the work to an app development firm.

You can go for an in-house team if you have the time and budget to hire banking app development professionals. However, if you want the app to be developed quickly, then opt for hiring an experienced team from an app development firm.

At this stage, third-party integrations for notifications, in-app messaging, and data analytics need to be done. You must ensure that this integration is secure and stable.

Step#7 Test the App

For any app development project, testing is what makes or breaks the product. Manual testing, as well as automation testing, should be done comprehensively.

This will iron out most of the bugs that would be there in the banking app. Load testing is also important, as the app should be stable even when thousands try to transact simultaneously.

All features should be tested for their smooth functioning. You can go for A/B testing, where you test two different variants of an app to find out which works better.

Step#8 Launch the App & Maintain it

After all the hard work, it is time to launch the app for the users. You can get their feedback by asking them to rate their experience and even write comments.

With the passage of time, you will have a fair idea of how your app is performing. Usage Data collected, including feedback, have to be analyzed for changes and upgradation.

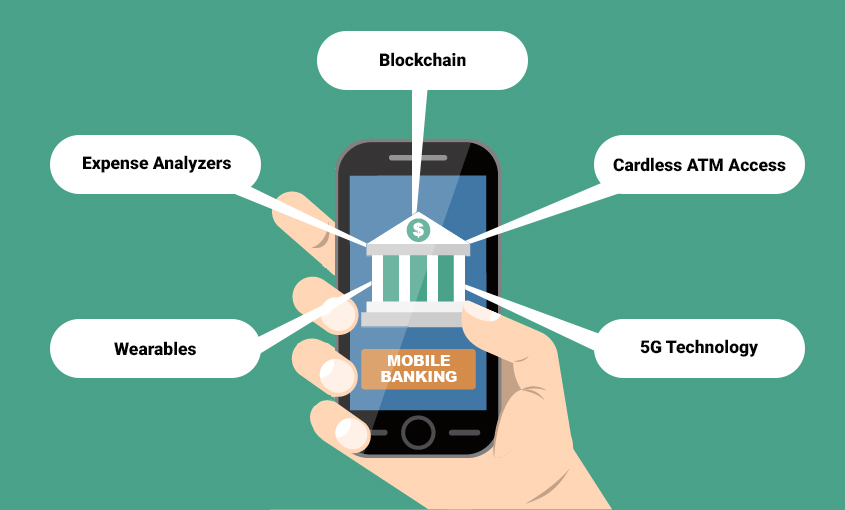

Mobile Banking App Features for the Present & Future

As technology progresses, we will see more innovative features incorporated into banking apps. Let’s have a look at some of the features you should include in your app to stand out from the competition.

Expense Analysers

These help the customers in specifically knowing where they have spent money. It also provides weekly, monthly, and yearly analysis of money spent. This helps users in managing their funds better.

Wearables

Wearables can be used to display banking information or send alerts related to financial transactions. Wearable devices used by banking apps include smartwatches, fitness trackers, and smart glasses.

Blockchain

Blockchain technology can be incorporated into banking apps. The advantage it provides is transparency, security, and improved speed.

Cardless ATM Access

Mobile banking apps can be used to provide customers to access ATM services without a card. They can receive a verification message on their banking app to get access to ATM transactions.

5G Technology

With 5G technology already introduced in some parts of the world and soon to be introduced in other parts, banking apps should be built with 5G connectivity in mind. This technology will enable banking via wearables, IoT, and 5G smartphones.

Logging Out…

Digitalization is the present and future of all services, and the reasons are obvious. As internet speeds become faster across the world, apps will increasingly be used for all purposes, including shopping, travel bookings, cloud kitchens, education, communication, entertainment, and financial services.

Mobile Banking apps are no longer a stand-out service provided by large banks but have become a necessity. For banks to compete & survive the competition, developing fool-proof apps are a must!

About the author:

Victor Ortiz is a Content Marketer with GoodFirms. He likes to read blog on technology-related topics and is passionate about traveling, exploring new places, and listening to music.

Victor Ortiz is a Content Marketer with GoodFirms. He likes to read blog on technology-related topics and is passionate about traveling, exploring new places, and listening to music.