eCommerce

The Evolution of eCommerce Enablers in SEA and Why We Need Them

For many, the eCommerce enabling industry (especially outside of logistics), with eCommerce enablers, is a somewhat abstract part of eCommerce – tried to put down a few words to shed some light on the sector.

Table of Contents

Background

In early 2012, we started Lazada in five countries. Back then, we were aiming to import the ‘Amazon eCommerce model’ into a region that had very little eCommerce at all. At the time, Amazon was almost entirely inventory based (i.e. not at all an eCommerce marketplace open to external vendors). Hence, this is what we set out to replicate when we launched Lazada in South East Asia. Roughly 18 months into our roller-coaster-ride of building an eCommerce leader from scratch in a highly dynamic region, we realized that we got the entire business model wrong. It then dawned on us that the more scalable and profitable role (business) model was not at all Amazon’s inventory-based eCommerce model, but instead Alibaba’s marketplace-based business model embodied in Tmall and Taobao. From that day on, we reset our entire business to become a marketplace instead of a closed-system and inventory based eCommerce platform. This turned out to be a very important juncture in Lazada’s evolution, not only because it allowed us to scale at a much faster pace and with much stronger unit economics (i.e. profitability per order), but also because, I believe, it was a critical component in ultimately finding a match in terms of the Alibaba acquisition of Lazada.

With the acquisition of Lazada, Alibaba kickstarted the market for what I call ‘front end focused eCommerce enablers’ (i.e. the enablers that focus on the commercial aspects of eCommerce, and not primarily fulfillment and logistics, i.e. the backend). Basically, Alibaba was looking to replicate the ecosystem of certified eCommerce enablers that had grown up alongside the large Chinese eCommerce marketplaces, such as Tmall. Some of the most well-known names of enablers in China are Baozun and Lily & Beauty. In this pursuit, Lazada opened up its platform for third parties (i.e. enablers) to manage marketplace eCommerce accounts on behalf of its merchants (i.e. the brands, distributors and retailers selling via Lazada already). This led to the birth of the South East Asian ecosystem of front-end eCommerce enablers.

The early South East Asian front-end eCommerce enablers mainly came from two sources – either they had been prompted by Lazada itself to start to trial the business model of eCommerce enabling outside of logistics, or alternatively they were logistics-focused eCommerce enablers that ventured into trialing front-end services on top of its previous backend focused offering (again, backend here meaning logistics and fulfillment). Our own company, Intrepid is an example of the former and the Thai-based enabler aCommerce is an example of the latter.

Where are we today and where are we heading?

Today, three-four years down the line, the ecosystem of front-end eCommerce enablers in South East Asia has evolved tremendously, with a handful of players that covers most countries in the region in a pan-regional offering to brands, retailers and distributors (e.g. Intrepid and aCommerce) as well as a set of local champions (e.g Onpoint and NSquared) in each of the region’s key markets.

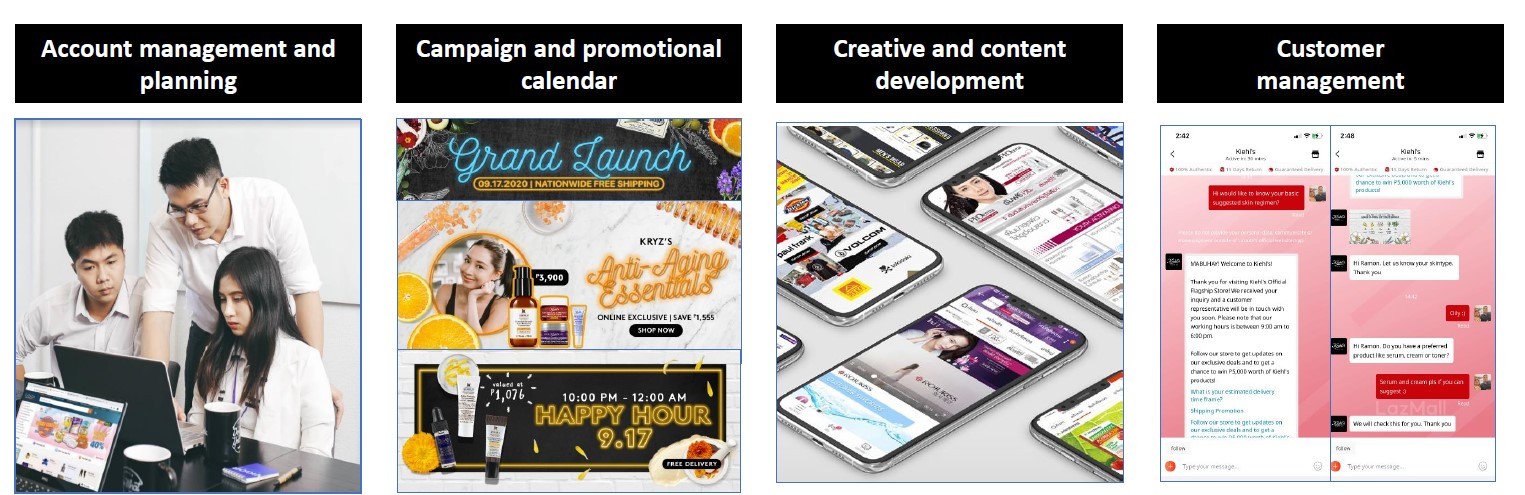

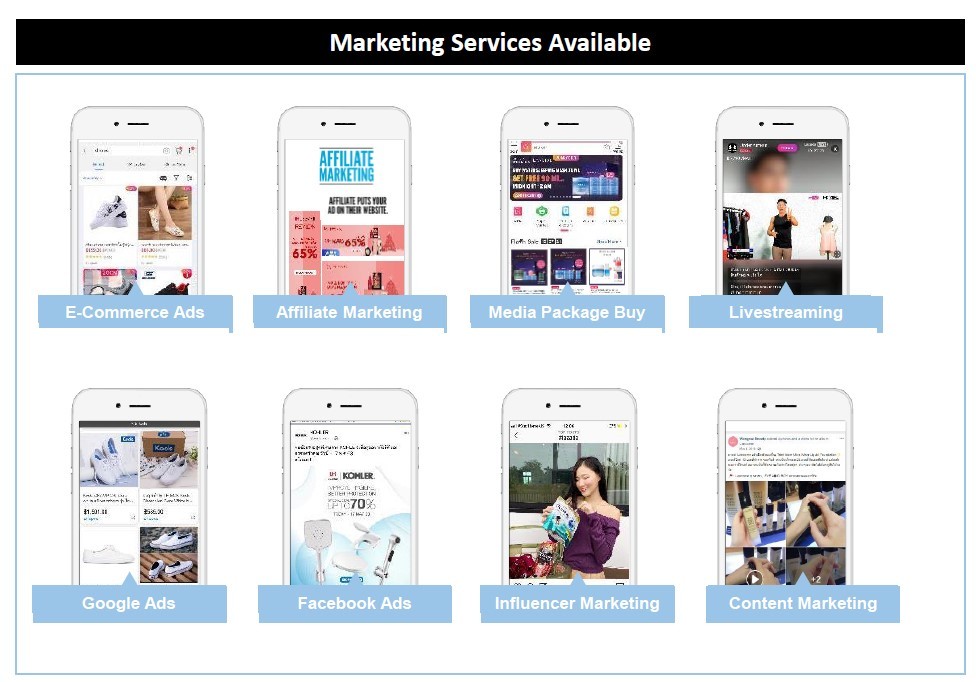

As the complexities of succeeding consistently on the large eCommerce marketplaces in the region have increased as well as the demands of their merchants have evolved, the sophistication of the service offering of the front-end enablers have evolved to encompass a broad range of commercial services – ranging all the way from store management, to data analytics services, to performance marketing services and adjacent SAAS tools.

Most of the larger marketplaces in South East Asia are following the role model of the Chinese eCommerce marketplaces, rather than the more traditional marketplace model of e.g. Amazon. The main difference in this regard is that the Chinese marketplaces, broadly speaking, contain much more complexity and creativity in terms of the on-platform-tools in form of e.g. data analytics, marketing, etc that the brands, distributors and retailers can leverage to succeed with their marketplace eCommerce. For one, Lazada recently implemented an on-platform marketing service similar to Alibaba’s Alimama marketing tech service that drives a substantial part of their profits in China. This more complex environment naturally increases the need for engaging a specialist partner, i.e. a front-end eCommerce enabler, to succeed consistently on the marketplace.

Why are the enablers needed?

-

Volume, frequency, depth and competition are just a few of the dimensions driving significant complexities in today’s eCommerce environment

“If a brand was only selling just one SKU/product, via one marketplace, with one store front and competing against one single competitor that was only changing prices once a week – for sure there would not be much benefits of engaging an enabler. However, the reality is that most brands are selling across 2-4 marketplaces, across multiple countries, with an assortment of 1,000s if not 10,000s products, with 100s of competitors that are all changing prices in real time. That’s the challenge the front-end enablers help their clients to win every day.”

-

Most brands and distributors are B2B organizations, not B2C

Often when traditional B2B organizations (e.g. brands and distributors), that are used to selling products in units of thousands to their clients, are first faced with the opportunity of directly serving consumers B2C through an eCommerce marketplace, they react by calling up their marketing department and asking them to name one person who can ‘handle the eCommerce part’. In an ever-changing, fast-paced and increasingly complex eCommerce market with intense competitive pressures, you can’t succeed without a focused B2C-organization built upon an obsession for winning the hearts and minds of consumers, rather than corporate clients.

-

A niched organization of eCommerce experts is hard to attract and retain

Furthermore, you also need a team comprising experienced eCommerce professionals, each with targeted and deep expertise within areas ranging from store management, campaign management, pricing strategy, performance marketing (across a long range of online channels and platforms), customer service (through voice, email & chat), data analytics, etc. Many times it’s difficult for a single brand to build these specialized teams consisting of a wide variety of eCommerce specialists and retain them over time. The front-end enablers allow for these teams to instead be leveraged across multiple brands and industries.

-

Proprietary tech and automation

Finally, the best-of-breed front-end eCommerce enablers have invested millions of USDs into their own proprietary technology platforms (e.g. Intrepid’s Powersell) that allow for automation and massive economies of scale in terms of managing a brands’ eCommerce presences simultaneously on multiple marketplaces across the entire South East Asian region. It is very difficult for a single brand to motivate a similar specialized tech investment into a marketplace eCommerce toolkit/platform.

Christopher Brinkeborn Beselin is now Chairman and Co-Founder of Fram^, a leading custom software development company in Vietnam. Over the years, we have been providing eCommerce development services to businesses around the world. If you’re finding an eCommerce solution or building an eCommerce development team, don’t hesitate to contact us right away!